Most people never receive any sort of financial literacy/ training as part of their formal education. Most people have to learn from their own experiences and the experiences of others. If you are always nervous about money and have always wanted to get it under control, here are some tips you can learn from Shecluded’s Wealth Advisor.

The following are some useful tips from a wealth advisor to you:

1. Givers can lack:

Women tend to be nurturers and care for people around them, sometimes this is to their detriment. A significant number of women advised gave more than 30% of their monthly income to relatives, friends, and religious institutions. While giving is a noble gesture, there is no reward if it prevents you from achieving your financial goals.

To help you strike a balance between being your brother’s keeper and achieving your financial goals, you should have a budget that you set for your giving. When that money runs out, you are done for the month!

2. Living beyond your means can lead to financial ruin:

It does not matter how much you earn from your job or business if you do not save any of it! If you make 100 million naira this year and you spend 100 million naira, you will be broke! It is important to realize that your income matters, but what you do with the income you earn matters even more.

You might have heard the saying “Keeping up with the Joneses”. This refers to trying to keep up with people around you, rather than living within your means.

For you to grow your wealth, you should keep track of your cash inflow and outflow, and follow a budget. It is only by tracking this, that you will notice if you are living beyond or within your means.

3. Don’t be a local champion

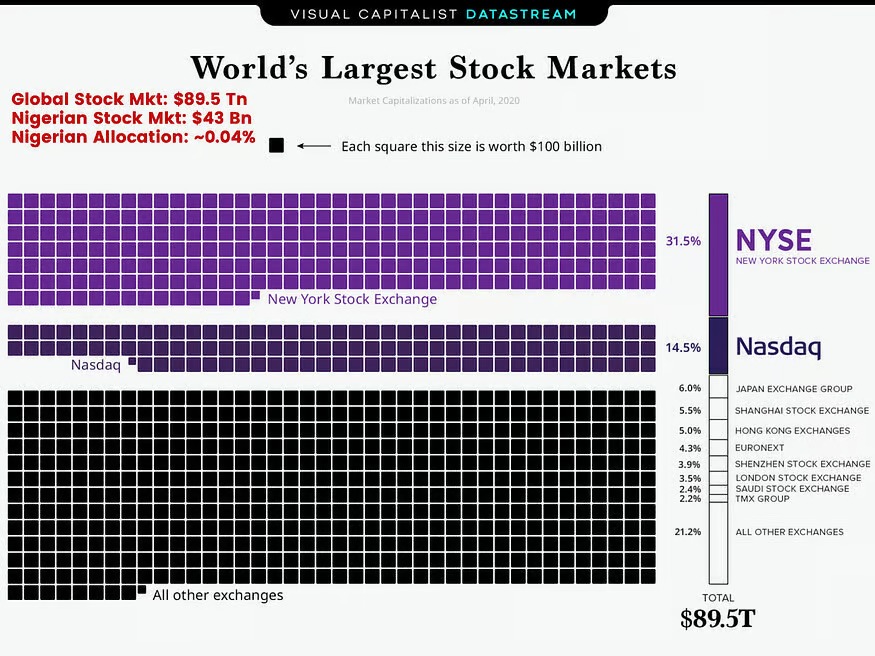

Nigeria is a small country when compared to the global financial network. It does not seem small, but it is! As an example, consider the fact that the Nigerian Stock Exchange (NSE) makes up only 0.04% of the global stock market.

If you only invest in opportunities in Nigeria, you are limiting yourself to very few investment opportunities. In addition, you are fully exposed to the currency risk (the constant naira devaluation against the US dollar) and inflation (currently at about 16%).

To begin building a solid investment portfolio, you must learn to diversify geographically and have a global mindset! Failure to do this will have you leaving money on the table.

4. Small, consistent effort will take you far.

Many people are afraid to start investing because they don’t have a large amount of cash saved up! The reality is that starting small with what you have is the best way to make progress fast. Thanks to innovation, you can start investing with as little as NGN1,000) using one of the many fintech investment platforms in Nigeria.

One of the best pieces of financial advice is to start investing early. The reason is simple: compound interest! As Einstein said, “compound interest is the 8th wonder of the world (the rich use it, the poor get used by it)”. Simply put, compound interest is the idea that the interest that your money makes also earns you interest, and that earned interest also earns you interest, and so on…

Source: http://thebalance.com

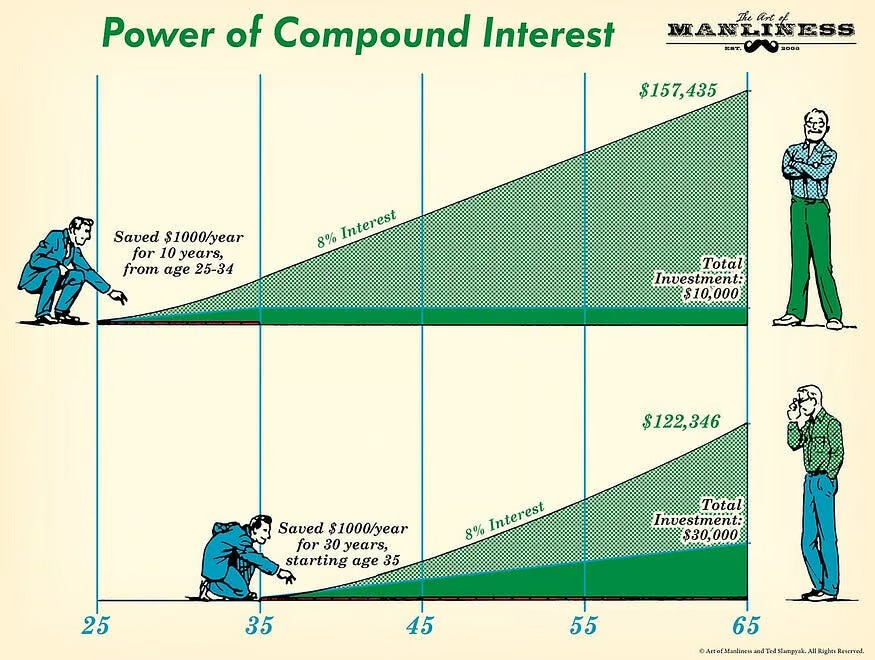

The importance of starting early is best illustrated by this example from theartofmanliness.com

“If you were to save $1,000 a year from age 25 to 34 in a retirement account earning 8% a year, and never invest a penny more, your $10,000 investment would grow to $157,435 by age 65. But if you don’t start saving until you’re 35 years old and then invest $1,000 a year for the next 30 years (that’s a total investment of $30,000), you’ll have only $122,346 by age 65. The bottom line: Start early, so your money has enough time to pile up.”

Source: Artofmanliness.com

5. Find your risk sweet spot!

One of the biggest factors that determine how wealthy you will get is how much risk you are willing to take on your money (this also applies to most areas in life!) Many women lack the confidence to invest in moderate to high risk investments, unfortunately, this lack of confidence to invest, contributes to the gender wealth imbalance between men and women.

To build real wealth, you must be willing to take on some risk, because as the saying goes, no risk, no reward! For you, this means that instead of investing in very safe/ conservative investments solely, you can diversify your portfolio by investing a portion of it in higher risk investments such as stocks.

In order to determine your asset allocation (how much risk you are willing to take with your portfolio), you can use a risk questionnaire such as this one! Your asset allocation is one of the most important determinants of your portfolio return, so you should pay attention to it!